UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to SectionPROXY STATEMENT PURSUANT TO SECTION 14(a) of theSecurities Exchange Act ofOF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

| Filed by the Registrant |   | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified Inin Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check | |

| No fee required. |

| Fee paid previously with preliminary materials. |

| Fee computed on table |

| ||

| ||

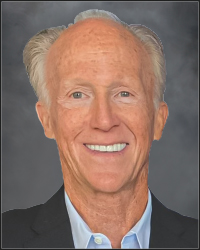

JEFFREY T. MEZGER

CHAIRMAN, PRESIDENTAND CHIEF EXECUTIVE OFFICER

February 26 , 2021

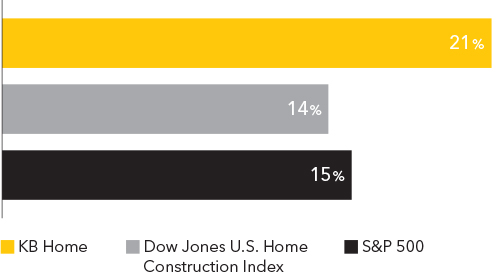

FIVE-YEAR ANNUALIZEDTOTAL STOCKHOLDER RETURN

Together with the Board of Directors and the management team of KB Home, I am pleased to invite you to participate in our 20212024 Annual Meeting of Stockholders. Due to public health restrictions related to COVID-19, and for the safety of our stockholders, the Annual MeetingThe meeting will be conducted virtually through an audio-onlyonline webcast at 9:00 a.m. Pacific Time on Thursday, April 8, 2021.18, 2024.

At the time of my last letter to stockholders,2023 in late February 2020, we were poised for a year of growth,Review

The KB Home team delivered healthy results in 2023, as we expected to expandsuccessfully navigated fluctuating market conditions, maintaining our scale through meaningful increases in revenues and deliveries at higher levels of profitability. Within two weeks of that letter, COVID-19 was declared a global pandemic, and we moved quickly to adapt our business to the changing conditions and related restrictions that ensued. With a focus on protecting the health and well-being oflong term. We were steadfast in our employees, customers and business partners, as well as their families, we took a decisive step in temporarily closing our sales centers and Design Studios in mid-March. Although every state in which we operate issued stay-at-home or similar orders, residential construction was deemed an essential activity in nearly all of our markets, allowing uscommitments to continue to build and deliver homes.

We shifted to using our enhanced virtual sales tools, giving customers the ability to shop for a new home from their mobile device or personal computer. We also established systems that enable customers to visit our communities and tour homes privately, unaccompanied by a KB Home employee. And we created processes for buyers to complete their Design Studio selections online. In early April, with protocols in place for operating safely, we began reopening our communities and Studios by appointment only, and we continued with this approach until more fully reopening to walk-in traffic in late May.

While our approach was conservative, closing our sales centers during the busiest time of the year — the industry’s Spring selling season — and reopening more slowly than some other homebuilders, we believe it was the right path. We took aggressive action in the interest of safety, while continuing to effectively run our business and prioritize cash preservation and liquidity, which we believe helped us successfully navigate the early months of the pandemic.

In May, as restrictions began to ease within many of our served markets, consumer optimism in those markets grew and our orders began to rebound significantly, steadily rising as the month progressed. Ultimately, what followed in the second half of the year, continuing into 2021, has been some of the strongest housing market demand that I have seen in my 40-year career as a homebuilder. The industry had already been poised for this, with Millennials, the nation’s largest adult population, in their prime household formation years, together with an underproduction of new homes over the last decade and a favorable mortgage interest rate environment. The pandemic played a significant role in propelling demand for homeownership and all the financial, health, safety, and emotional security it offers.

As a result, we had a strong finish to 2020 and believe we are well-positioned for an outstanding year in 2021. I want to thank our employees for their perseverance in taking care of our customers, duringprotecting and further building our brand, positioning the Company for profitable growth, and advancing our award-winning sustainability program.

Reflecting on 2023, I am reminded of the remarkable contrast between how the year began and ended. With the start of the year characterized by a very fluid year,continuing soft demand environment resulting primarily from higher mortgage interest rates, our initial 2023 guidance projected about $5.5 billion in housing revenues, equating to roughly 11,400 deliveries. We achieved much stronger results, closing 13,236 homes and their contributionsgenerating revenues of $6.4 billion. Two important areas of focus in 2023 were lowering our costs to build and compressing our build times——aspects of our business that had been significantly impacted by the supply chain challenges of the prior few years——and we successfully executed in both areas. In addition, we took steps to work with our buyers on affordability, as they adjusted to the solidhigher rates. Our results, we produced. As toalong with the detailsrepurchase of 11% of our 2020 performance, we generated total revenuesshares outstanding since the start of $4.2 billion andthe year, contributed to diluted earnings per share of $3.13, an increase of 10% year over year. The net order momentum that we experienced throughout the second half of the year drove our 2020 ending backlog value up by over 60% year over year to $3.0 billion, its highest level in 15 years. We continued to reinvest$7.03 and 15% growth in our Company and, despite pausing most land acquisition and development activity atbook value per share in 2023 to $50.22.

Together with expanding our scale, returning capital to stockholders has become one of our key priorities in allocating the onset of the pandemic,substantial cash that our business generates. We remain focused on striking an appropriate balance in managing these priorities. In 2023, we spent $1.7invested $1.8 billion to acquire and develop land and returned nearly $470 million in 2020, slightly higher than the previous year. We ended the year with a solid position that provides us with the lots neededcash to support the substantial rise in delivery volume anticipated for 2021,stockholders primarily through share repurchases, as well as all the lots we expect to need for further delivery growth in 2022. In addition to investing in future growth, we maintained our focus on increasing stockholder returns. We implemented another substantial increase in ourregular quarterly cash dividend in our 2020 fourth quarter, marking the second consecutive year we have meaningfully raised our dividend, which is now six times its level from two years ago. We returned $38 million of our cash to stockholderswe increased by approximately 33% in 2020, nearly doubleJuly 2023.

Building for the prior year’s level.Future

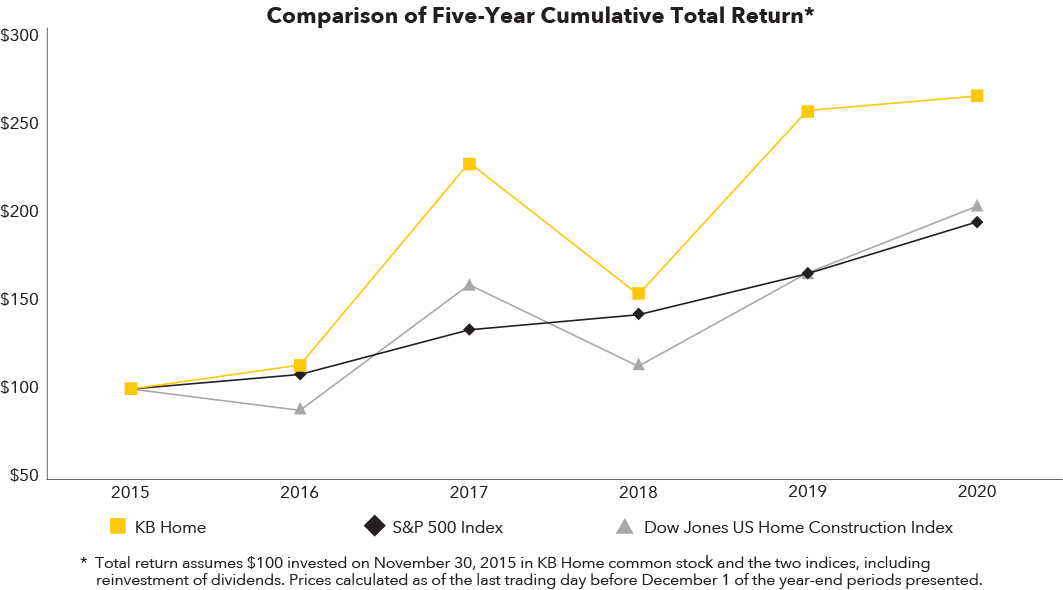

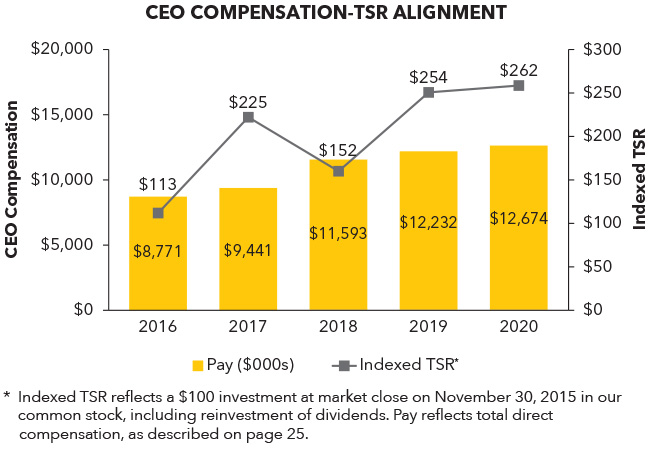

We take a balanced approach to utilizing the substantial cash flow that our business generates, with the objective of expanding our scale while increasing returns. With our return on equity rising approximately 600 basis points over the past five years, we have produced an annualized total stockholder return of more than 20% during that timeframe, well above our primary industry benchmark and the broader market, and among the highest in our peer group.

Along with the healthy and profitable growth of our Company, a key priority for us is continuing to improve the satisfaction of our customers. For us, fulfilling our customers’ needs is one of the best ways we can continue to enhance our brand, as our objectiveOur vision is to be the most customer-obsessed homebuilder in the world. A home is the largestWe partner with our customers to help them achieve their dreams of homeownership, creating a highly satisfying experience through a compelling, simple, and most meaningful purchase most of us make in our lifetimes, and we strive to make thepersonalized homebuying experience an exceptional one.process distinguished by phenomenal customer service. I am very proud ofthat in 2023, we maintained our accomplishments relative to this objective, particularly in achievingstatus as the highest customer satisfaction ratings in our history in 2020, at a time when we were managing through the challenges posed by the pandemic. We are also the highest-ranked#1 customer-ranked national homebuilder, based on buyer satisfaction surveys on TrustBuilder®, a third-party, industry-specific homeowner review site, earning 4.6 out of 5 stars, and achieving or tying for the top rankingsite. Rankings are established entirely on direct responses from homebuyers, reinforcing that our distinct homebuying experience resonates with them. Ensuring we operate our business in nearly everyalignment

with our values is one of our markets.the most impactful ways we can continue building a bigger and more profitable Company in the future.

Our commitment to sustainability

Sustainability is one more significantanother way in which we are investingbuilding for the future, and creating longer-term value. Whenit is an area in which we began this journey nearly 15 years ago, sustainability was considered a luxury in homebuilding.have led our industry for 17 years. We saw an opportunityendeavor to help protectfind ways to offer energy- and water-efficient features that conserve resources while lowering the environment while reducing the overalltotal cost of long-term homeownership for our customers through lower utility bills.homeownership. We became the firstcall it “doing well by doing good”——a philosophy that has resulted in national homebuilder to build 100% ENERGY STAR® certified new homes, and we have delivered nearly 150,000 ENERGY STAR certified new homes to date, more than any other national homebuilder. Our sustainably designed homes are estimated to have cumulatively saved our homeowners approximately $780 million in utility bills and lowered carbon emissions by approximately 5 billion pounds, the equivalent of removing nearly 490,000 cars from the road for one year.

During 2020, we were honored to be recognized once again by the U.S. Environmental Protection Agency with the following awards, each of which represented another year of unprecedented achievement for a national homebuilder:

2020 ENERGY STAR Partner of the Year — Sustained Excellence Award — Our 10th consecutive award for demonstrating leadership in energy-efficient construction;

2020 ENERGY STAR Certified Homes Market Leader Awards — A record 21 awards in all, one in eachrecognition of our primary markets nationwide, recognizing excellence in energy-efficient home building;achievements. We successfully executed on several key initiatives during the last year, and

2020 WaterSense® Sustained Excellence Award — The sixth consecutive year I encourage you to learn more about what we have received this award forare doing to drive a more sustainable future by visiting our achievements in constructing water-efficient homes.

website. In addition, to energy efficiency, we also advanced our efforts in the area of renewable energy, achieving the milestone of delivering over 11,000 solar-powered homes to our customers in the past 15 years, producing an estimated total of 428 million kilowatt hours of electrical power. KB Home has been a leader in solar homebuilding and was one of the first national builders to offer it .

We have substantially expanded our view of sustainability beyond energy efficiency to encompass water conservation, waste reduction and healthier indoor environments. This last point has proven to be particularly relevant in the midst of the pandemic. Our homes include high-performance ventilation systems that regularly introduce fresh outdoor air, and, in our Design Studios, we offer options, from anti-microbial door handles to touchless faucets, that reduce the spread of germs. In 2020, we announced a groundbreaking healthy home research project in partnership with the Well Living Lab, which was founded as a collaboration between Delos® and the Mayo Clinic. It is the first lab to exclusively focus on researching how indoor environments can improve human health and well-being.

Last year also marked a year of enhanced transparency about the “social” aspect of our sustainability program. We have had long-established standards and practices to guide how we conduct ourselves as a company and in relation to our employees and business partners. In 2020, we publicly articulated some of our guiding principles, publishing a Human Rights statement, a Supplier Code of Conduct, and a policy on Responsible Marketing practices. We also reviewed and updated our Ethics Policy, as we do each year, and conducted Company-wide training on this policy, which all of our employees are required to complete annually.

As a result of our leadership in ESG, we were pleased to be the only national builder to receive two distinct honors. The first was from Newsweek®, in being named to its 2021 list of America’s Most Responsible Companies for demonstrating leading environmental, social and governance practices. We were also selected by Forbes® for its 2021 list of America’s Best Midsize Employers. We are a people-driven business and this recognition, which is based on employee feedback about working at KB Home and the likelihood of recommending us as an employer, is very gratifying to our team.

Our 14th17th Annual Sustainability Report, the longest-running publication of its kind for a national homebuilder, is slated for publication in conjunction with Earth Day 2021. April.

Closing Thoughts

We encourage you to review our report and learn more about our consistent,believe the long-term approach and vision for buildingoutlook for the future.

We are offnew housing market remains favorable, driven by low existing home inventory levels, solid employment and wage growth. Demographics have been and, we expect will continue to be, a significant factor, with the largest generational cohorts, millennials and Gen Z’s, demonstrating a strong startdesire for homeownership. We have built a solidly profitable business, based upon our highly personalized, customer-oriented and differentiating Built to Order business model, with a recognized brand that consumers trust. Our talented and long-tenured management team is ready to lead our Company forward, and we have demonstrated the ability to navigate varying market conditions with a thoughtful approach focused on the long term. With a solid backlog in 2021, amid a backdrop of continuing robust market conditions. We are poised for a tremendous year asplace, we resume our growth into a larger, more profitable company, which will help drive expansion of our return on equity to an expected 17%. Whilebelieve we are mindful that we remainwell positioned to achieve our delivery target for 2024. We anticipate achieving double-digit growth in a pandemic, with the potential to disrupt our business, we are confident in the strength ofending community count this year and expect our position, which is the best it has been in over a decade. We have an experienced, dedicated team,cash generation, as well as solid balance sheet, a healthy lot position, the cash flowliquidity, will enable us to invest in community count expansion and maintain a higher quarterly cash dividend, and a business model that generates high customer satisfaction and has demonstrated appealour future growth while continuing to homebuyers.return capital to stockholders.

Our team at

I am excited about the Company’s future, as the KB Home isteam remains committed to managing our business to drive long-term stockholder value, and alongvalue. Together with our Board of Directors, we sincerely thank you for your investment and continued support.

Sincerely,

Sincerely,

TABLE OF CONTENTSJEFFREY T. MEZGER

Chairman and Chief Executive Officer

March 8, 2024

| KB Home ■ 2024 Proxy Statement | 1 |

Table of Contents

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERSNotice

THURSDAY,APRIL8,2021of 2024 Annual Meeting

of Stockholders

Thursday, April 18, 2024

9:00 a.m., Pacific Time

WebcastMeetingLocation:www.meetingcenter.io/216002295

meetnow.global/M9X547D

| Items of Business | |

| 1. | Elect nine directors for a one-year term. |

| 2. | Advisory vote to approve named executive officer compensation. |

| 3. | Ratify Ernst & Young LLP’s appointment as KB Home’s independent registered public accounting firm for the fiscal year ending November 30, 2024. |

Elect 12 directors, each to serve for a one-year term.

Advisory vote to approve named executive officer compensation.

Ratify Ernst & Young LLP’s appointment as KB Home’s independent registered public accounting firm for the fiscal year ending November 30, 2021.

Approve the Amended Rights Agreement.

The accompanying Proxy Statement describes these items in more detail. We have not received notice of any other matters that may be properly presented at the meeting.

RECORD DATE

Record Date

You are entitled to vote at the meeting and at any adjournment or postponement of the meeting if you were a stockholder as of the close of business on February 5, 2021.26, 2024.

By order of the Board of Directors,

WILLIAMA.(TONY)RICHELIEU

VicePresident,CorporateSecretaryand

AssociateGeneralCounsel

LosAngeles,California

February 26 , 2021

March 8, 2024

VOTING

Voting

Please vote as soon as possible to ensure your shares will be represented. Holders of record may vote via the Internet, telephone or mail. Stockholders whose shares are held by an intermediate broker or financial institution, also called beneficial holders, must vote in the way their intermediary provides. Holders with a control number from our transfer agent can vote at the Annual Meeting.

meeting.

VIRTUAL MEETING FORMATVirtual Meeting Format

Due to COVID-19-related public health restrictions and for the safety and well-being of our stockholders, the Annual MeetingThe meeting will be conducted online through an audio-only webcast. The accompanying Proxy Statement contains information about participating in the Annual Meeting. Theremeeting. The meeting will behave no physical location for the Annual Meeting.location.

ANNUAL REPORTAnnual Report

Copies of ourOur Annual Report on Form 10-K for the fiscal year ended November 30, 20202023 (“Annual Report”), including audited financial statements, areis being made available to stockholders concurrently with the accompanying Proxy Statement on or about February 26, 2021.March 8, 2024.

| Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be Held on April 18, 2024: Our Proxy Statement and Annual Report are available at www.kbhome.com/investor/proxy. |

| KB Home ■ 2024 Proxy Statement | 3 |

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting To Be Held on April 8, 2021: Our Proxy Statement and Annual Report are available at www.kbhome.com/investor/proxy.

Your Board is furnishing this Proxy Statement and a proxy/voting instruction form or Notice of Internet Availability to you to solicit your proxy for KB Home’s 20212024 Annual Meeting of Stockholders (“Annual Meeting”). We anticipate these proxy materials will be made available to stockholders on or about February 26, 2021. A briefMarch 8, 2024 and filed with the Securities and Exchange Commission (“SEC”) on the same date. Below is summary of information about the Annual Meeting is presented below.Meeting. Please review all the more detailed information in this Proxy Statement before voting.

|  |

| Location: |

| Thursday, April | |

| 18, 2024 |

| Audio-only Webcast Meeting at |

|

meetnow.global/M9X547D |

ItemsofBusiness | BoardRecommendation | VotingStandard | |||

Election of Directors |

| FOReach of the | Majority of Votes Cast | ||

Advisory vote to approve named executive officer (“NEO”) compensation, also known as “Say-on-Pay” |

| FOR | Majority of Shares Present and Entitled to Vote | ||

Ratify Ernst & Young LLP’s appointment as |

| FOR | Majority of Shares Present and Entitled to Vote | ||

|

|

| |||

PARTICIPATING IN THE ANNUAL MEETING WEBCAST

Online access to theThe Annual Meeting webcast at www.meetingcenter.io/216002295meetnow.global/M9X547D will open at approximately 8:45 a.m., Pacific Time, on April 8, 2021.18, 2024. To access the audio-only meeting, vote and ask questions, you will need to have a valid control number from our transfer agent, Computershare and use the password: KBH2021.Computershare. Holders of record will receive their control number on the notice or proxy card Computershare distributes to them.

Questions may be submitted before or during the Annual Meeting. To submit a question in advance, visit meetnow.global/M9X547D before 8:59 p.m., Pacific Time, on April 17, 2024, and enter a valid control number. We will endeavor to answer as many stockholder questions as time permits. However, we may not respond to questions that are not pertinent to Annual Meeting matters or our business. Single responses to a group of substantially similar questions may be provided to avoid repetition. We ask attendees to help us keep the proceedings orderly by following the meeting rules of conduct.

If you are a beneficial holder, meaning an intermediate broker or financial institution holds your shares, you must register with Computershare no later than 5:00 p.m., Eastern Time, on April 5, 202115, 2024, to participate inbe able to vote and ask questions at the Annual MeetingMeeting. . To register, please provide Computershare with proof of your KB Home stockholdings, known as a legal proxy, obtained from your intermediary,broker or financial institution, along with your name and email address. Submit theseSend the items to Computershare viaby email atto legalproxy@computershare.com (use KB Home Legal Proxy in the subject line); or by mail to: Computershare, KB Home Legal Proxy, P.O. Box 43001; Providence, RI 02940-3001. Computershare will send an email you confirmation of your registration.

Beneficial holders who cannot obtain a legal proxy can attend the Annual Meeting as a guest though withoutat the abilityabove-noted Internet address, but they will not be able to vote or ask questions, at the Internet address and with the password noted above.

Questions may be submitted before or during the Annual Meeting. To submit a question in advance, visit www.meetingcenter.io/216002295 before 8:59 p.m., Pacific Time, on April 7, 2021 and enter a valid control number. As many stockholder questions will be answered as time permits. However, we may not respond to questions that are not pertinent to meeting matters or our business. Single responses to a group of substantially similar questions may be provided to avoid repetition. We ask that attendees please help us keep the proceedings orderly and follow the Annual Meeting rules of conduct.questions.

| KB Home ■ 2024 Proxy Statement | 4 |

| Our Values | |

| We make relationships the foundation for all we do. It takes strong relationships to build a home. To build a strong relationship it takes respect, integrity, and open and honest communication. Our employees are the heart and soul of KB, and that belief in relationships defines how we behave toward each other, how we treat our customers through every step of the process, and, how we work with our suppliers, trade, and municipality partners. |

| We build homes that make lives better. Innovative design and quality construction standards are the cornerstones of our brand. Behind our continuous drive to build exceptional homes is a passion for the wellbeing of those who live in them. From architecture to construction to customer service, we care about making our buyers’ lives more comfortable, convenient, and healthy. That’s how we lead the industry in customer satisfaction, and strive to keep it that way. |

| We believe that everyone deserves a home that’s as unique as they are. Our business model is built on a simple, yet radical idea: a house becomes your home when it’s an expression of who you are. That’s why we give our customers the ability to choose — from homesite to elevation, from floor plan to design options — and a buying experience that’s personalized from end-to-end. |

| We deliver more for less. We believe that every customer deserves a home that lives up to their dreams. That’s why it’s our shared responsibility to ensure that what we build delivers great value, so that every customer gets a home — and a homebuying experience — that can exceed their expectations without exceeding their budget. It’s a disciplined and responsible approach to homebuilding that’s good for our homebuyers and our business. |

| We strive for a better shared future. From individuals, to families, to whole communities, our collective actions can have a beneficial impact on the world. We believe that every decision we make, from how we manage our workplace, to how we run our operations, has the potential to advance environmental, social, and economic sustainability. |

A key component of our focus on long-term value creation is our commitment to sustainability, which we see as encompassing our environmental, social and governance (“ESG”) practices highlighted on the next few pages. This commitment flows from our core Built on Relationships® business philosophy. Before we build a home, we seek to build a personal connection through close partnerships with our buyers, offering a compelling, simple and personalized process distinguished by phenomenal customer service. We also endeavor to create and maintain other key relationships for our operations, including with the communities we develop, suppliers, trade contractors, land sellers and team members. While financial returns are our top priority, we believe our distinctive and deeply rooted purpose-driven, people-centric approach to doing business has been the foundation of our success over the 60+ years we have been delivering homes to and serving our customers and their communities. We strive to make the communities we develop better places to live, work and play, and encourage our teams to get involved at a local level. This includes their participation in our KB Cares program, which supports several charitable activities.

ENVIRONMENTAL AND SOCIAL PRACTICES

We are proud of our nearly 15 years of leadership within the homebuilding industry in constructing communities of sustainable homes. Over their multi-decade use, our homes are designed to meaningfully conserve natural resources and reduce greenhouse gas emissions associated with day-to-day living activities compared to typical new and resale homes. We believe this is the most effective way we can make a positive contribution to the global effort to address climate change. In recent years, we have expanded our sustainability portfolio to include enhancing our homes’ indoor air environment. We also maintain a human capital strategy that supports a diverse and inclusive workforce with equal opportunity and programs for training and career advancement, strong benefits, incentives, and health, safety and wellness initiatives. Our annual sustainability reports, which we have published for 13 years, contain more information about our programs, goals and achievements.

Select attributes of our approach to sustainability, which our Board oversees as part of our overall business strategy, are summarized below.

| KB Home ■ 2024 Proxy Statement | 5 |

Energy Efficiency  |

| Water Efficiency  |

| Impact  | ||

~150,000 U.S. EPA ENERGY STAR® certified homes built since 2000, more than any other homebuilder 100% ENERGY STAR certified home commitment since 2008 (only ~ 10% of all new homes built in the U.S. in 2019 were ENERGY STAR certified) 11,000+ total solar homes built 32% of homes sold were all electric (i.e., without natural gas systems) |

| 16,000+ EPA WaterSense® labeled and Water Smart homes built since 2005, more than any other homebuilder 700,000+ WaterSense labeled fixtures installed 100% WaterSense labeled fixture commitment since 2009 |

| Approximately five billion pounds cumulative CO2 emission reduction (est.) from our ENERGY STAR certified new homes, compared to typical homes without ENERGY STAR features 1.5 billion gallons of water saved annually (est.) from our new homes and fixtures, compared to typical existing homes that do not have the same water saving items | ||

Indoor Air Enhancement  |

| Workforce Diversity*  |

| Social Standards  | ||

High-efficiency air filters are standard in our homes Only homebuilder in the Well Living Lab Alliance, a global consortium of leading companies working to improve indoor air environments |

|

| Female | Minority |

| Publicly available policies include: ■

Ethics Policy ■

Human Rights statement ■

Supplier Code of Conduct ■

Responsible Marketing practices |

| Managers | 33% | 21% |

| ||

| Overall | 42% | 33% |

| ||

| * Data as of December 31, 2020. Please see page 11 for Board of Directors diversity. |

| ||||

| Back of Contents | ||

|

As strong corporate governance is a key factor in driving long-term stockholder value, theThe Board has implemented a robustestablished an appropriate governance framework and leading practices to oversee the management of our business, as highlighted below and discussed in other sections of this Proxy Statement*. Further below, we detail how the Board’s approach to corporate governance aligns with the principles of the Investor Stewardship Group, which is a coalition of some of the world’s largest investors and asset managers, including several of our top stockholders.summarized below.(1)

Independence | ■ All | |

■ The Lead Independent Director position has significant responsibilities and authority, as described below. ■ Only independent directors serve on Board committees. | ■ During | |

Accountability | ■ All directors are elected on an annual basis under a majority voting standard. ■ We have one class of voting securities allowing each holder one vote for each share held, and no supermajority voting requirements (except per Delaware law, our state of incorporation). ■ We proactively engage with our stockholders year-round on our business strategy, performance and outlook. ■ Directors and senior executives are subject to significant stock ownership requirements, and they and all employees may not pledge or hedge holdings of our securities. ■ Executive officers are subject to an incentive-based compensation recovery policy, and all unvested employee equity awards require double-trigger vesting in a change in control. | |

2023 Meetings and Attendance | ■ The Board held | ■ The Audit and Compliance Committee held six meetings. ■ The Management Development and Compensation Committee held six meetings. ■ The Nominating and Corporate Governance Committee held five meetings. ■ Each incumbent director standing for election attended |

■

| We expect directors to attend our annual stockholder meetings. All directors attended our | |

Effectiveness Standards | ■ No more than one director may be an employee. ■ Non-employee directors hold an executive session without management at each regularly scheduled Board meeting. ■ Directors | must retire as of the first Annual Meeting following their 75th birthday. Our directors’ average age is 61.

|

■ Directors |

| |

|

| |

| if they are a public company chief executive officer, on more than two other public company boards. No directors are over-boarded.

|

INVESTOR STEWARDSHIP GROUP PRINCIPLES ALIGNMENT

|

| ||

■

| The Board

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

|

Additional information about our corporate governance policies, processes

|

BOARD AND COMMITTEE GOVERNANCE STRUCTURE

Jeffrey T. Mezger, our CEO, has served as Chairman of the Board since 2016. The non-employee directors of the Board have elected Mr. Mezger as Chairman based on their belief that with his fundamental understanding of our business model and effective operational leadership, and capable service as a director since 2006, and their belief that combining the roles of Chairman and CEO roles enhances our ability to achieve our long-term growth goals.strategic and operational objectives more so than separating the roles. Board governance is balanced with a strong Lead Independent Director position, which is designed to maintain the Board’s firm independent oversight. Melissa Lora has served as Lead Independent Director since 2016. In addition, all committees are led by2016 and composed solely of independent directors.

will continue to do so through her current term.

Key Lead Independent Director Key Duties

Presides at all Board meetings where the Chairman is not present and at all executive sessions and meetings of the non-employee directors, which may be called at any time and for any purpose.

Consults with the Chairman and the non-employee directors regarding meeting agendas and schedules and the content and flow of information to the Board.

| ■ | Presides at all Board meetings where the Chairman is not present and at all executive sessions and meetings of the non-employee directors, which may be called at any time and for any purpose. |

| ■ | Consults with the Chairman and the non-employee directors regarding meeting agendas and schedules, as well as the content and flow of information to the Board. |

| ■ | Provides Board leadership if there is (or there is perceived to be) a conflict of interest with respect to the role of the Chairman who is also the CEO. |

| ■ | If requested by major stockholders, being available to them for consultation and communication as appropriate. |

| ■ | Any additional duties set forth in our Corporate Governance Principles or By-Laws, or as the Board may determine from time to time. |

| (1) | Additional information about our corporate governance policies, processes and procedures is provided in Annex 1 |

| KB Home ■ 2024 Proxy Statement | 6 |

Our Board is elected by our stockholders to oversee the management of our business and affairs and assure stockholders’ long-term interests are being served. Among other specified activities, the Board as a whole, or through its standing committees, reviews assessments of and senior management’s plans with respect to significant risks we face. As described under “Commitment to Sustainability,” the roleBoard oversees our sustainability program as part of the Chairman who is also the CEO.our overall business strategy.

If requested by major stockholders, being availableRisk Management Structure and Processes. The Board has delegated oversight of certain risks to its standing committees, as described below. The committee chairs report to the Board about such delegated risks and other matters at each Board meeting. The Board itself monitors significant enterprise-wide operational and financial risks to our business, and management’s strategies to address or mitigate them, for consultationthrough briefings our CEO, Chief Financial Officer (“CFO”) and communicationPresident and Chief Operating Officer (“COO”) provide at each Board meeting and between meetings, as appropriate. The Board also receives regulatory and legal briefings from our general counsel.

Any additional duties set forthFinancial and Operational Risk Areas. The Board reviews and approves our shelf registration statements and debt and equity offerings thereunder, in some cases delegating the pricing of such transactions to a standing or ad hoc committee of independent directors, as well as our Corporate Governance Principlesunsecured revolving credit facility and term loan agreements, and our share repurchase programs. The Board also approves land acquisitions if the purchase price or By-Laws, orthe purchase price plus expected land development exceed certain thresholds. Though no such land acquisition reviews occurred in 2023, in such cases, the proposed project, as with all our communities, will have previously been assessed through our standard local, regional and corporate review processes.

Cybersecurity Risk Review. The Board through its Audit and Compliance Committee monitors cybersecurity risks and our evolving physical, electronic and other protection strategies and initiatives. This includes engaging in periodic reviews with management covering our cybersecurity tools and resources, threat environment, incident reporting procedures and future plans. Our chief information officer conducts this review with the committee, most recently in January 2024. Our chief information officer is supported by a chief information security officer and other employees and dedicated contract personnel experienced with information technology and cybersecurity matters who are responsible for evaluating and deploying the cybersecurity measures we employ, as described in the Annual Report.

|

|

|

| ||

Audit and ComplianceCommittee | Members: ■ Dr. Thomas W. Gilligan (Chair)

■ Jose M. Barra ■ Dorene C. Dominguez | ■ Kevin P. Eltife ■ Dr. Stuart A. Gabriel

|

|

| |

|

|

|

| ||

|

|

|

|

Board committees’ responsibilitiesPrincipal Responsibilities:

Oversees our corporate accounting and composition did not change in 2020, other than Messrs. Collinsreporting practices and Eltife joining theaudit process, including our Independent Auditor’s qualifications, independence, retention, compensation and performance, and our compliance with legal and regulatory requirements; and may approve our incurring, guaranteeing or redeeming debt. Four Audit Committee in October. In January 2021, Ms. Kozlak joined, and Ms. Lora replaced Kenneth M. Jastrow, II as Chair of, the Compensation Committee; Ms. Lora and Mr. Weaver rotated off the Audit Committee; and Mr. Weaver joined the Nominating Committee. Attendance percentage figures are averages.

|

The Board oversees our management’s plans, policies and processes for identifying, assessing and addressing business-related risks while advancing our strategic growth goals. To monitor COVID-19’s initial impact on our business, directors held bi-monthly conference calls with management from early April through July 2020, which included presentations and discussion on the evolving risk environment for our operations and financial position. The Board has also delegated certain risk oversight responsibilities to its committees, as described below. At each Board meeting,members, including the chair, of eachare “audit committee reports on the risks their committee has discussed with management, as well as their committee’s other activities.financial experts” under SEC rules.

Delegated Risk Oversight:

| ■ | ||

|

|

| ■ | The assessment follows the COSO Enterprise Risk Management Integrated Framework and is a component of how our executive team sets business strategies and objectives and manages operations, including our sustainability initiatives. | |

| ■ | This assessment’s outcome drives our internal audit department’s activities for the subsequent 12 months, which are based on a committee-approved annual audit plan. The internal audit department’s performance against the approved audit plan, along with the department’s audit findings, are reported and discussed at the committee’s quarterly meetings and on request. |

| ■ | Evaluates our management of matters in which we have or may have material liability exposure. |

| ■ | Per its Charter, discusses with management our policies and |

| ■ | Receives and discusses reports |

KB Home ■ 2024 Proxy Statement | 7 |

| Management Development and CompensationCommittee (“Compensation Committee”) | Members: ■ Melissa Lora (Chair) ■ Arthur R. Collins ■ Jodeen A. Kozlak |

■ Brian R. Niccol ■ James C. Weaver |

Principal Responsibilities:

Evaluates and recommends our CEO’s compensation; determines compensation for the CEO’s direct reports; evaluates and recommends non-employee director compensation; and oversees our policies and programs relating to significant human resource matters, including leadership development and continuity, non-discrimination and equal employment opportunity policies, and initiatives designed to foster the diversity and inclusion of talents, backgrounds and perspectives within, and to support the health and safety of, our workforce. Frederic W. Cook & Co., Inc. (“FWC”) assists the committee with executive and non-employee director compensation as its outside compensation consultant.

Delegated Risk Oversight:

| ■ |

|

| ■ | Annually reviews our compliance with our equity-based award grant policy, and our human capital development and management succession planning (both short- and long-term) for all levels of our organization, which, among other things, assesses executive bench readiness and diversity within our workforce. |

| ■ | Reviews and, as appropriate, approves the compensation arrangements our senior human resources personnel develop. |

| ■ | Based on this oversight approach, including the results of our most recent annual employee compensation risk assessment, we do not believe that risks arising from our present employee compensation policies and programs, including those applicable to senior executives, are reasonably likely to have a material adverse effect on us. |

Nominating and Corporate Governance Committee | Members: ■ James C. Weaver (Chair) ■ Arthur R. Collins ■ Dorene C. Dominguez |

■ Kevin P. Eltife ■ Dr. Thomas W. Gilligan |

|

Principal Responsibilities:

Oversees our corporate governance policies and practices; and as further discussed in Annex 1, reviews “related party transactions;” identifies, evaluates and recommends qualified director candidates to the Board; and administers the annual Board evaluation process.

Delegated Risk Oversight:

| ■ | Oversees corporate governance-related risks, including assessing potential related party transactions, and evaluating the mix of director skills and experience with that of potential director candidates and the Board’s needs. |

| ■ | Reviews proposed updates to our core |

| ■ | Monitors on an annual basis our political contributions and participation in industry trade associations. |

Governance Documents Availability

Our Certificate of Incorporation, By-Laws, Corporate Governance Principles, Board-approved charters for each standing committee and Ethics Policy serve as the foundation of our corporate governance. Each document, along with each of our Securities and Exchange Commission (“SEC”) filings, is available online for viewing, printing or downloading at www.investor.kbhome.com/corporate-governance. These documents are also available in print upon request. The information on our website is not incorporated by reference into and does not form a part of this Proxy Statement.

Board Committee memberships changed on April 20, 2023, as follows:

| ■ | Timothy W. Finchem, who served on the Compensation Committee and Nominating Committee, retired from the Board. |

| ■ | Mr. Barra joined the Audit Committee upon his election to the Board. |

| ■ | Mr. Collins rotated off the Audit Committee and joined the Nominating Committee. |

Communicating with the Board

Any interested party may writeThere were no other changes to the Board the Chairman of the Board, the Lead Independent Director or any other directorCommittees’ composition in care of our Corporate Secretary at KB Home, 10990 Wilshire Boulevard, Los Angeles, CA 90024.2023.

| KB Home ■ 2024 Proxy Statement | 8 |

| Back of Contents | ||

|

We have a balanced and well-diversifieddiverse Board composed of actively engaged directors possessing skill sets in a range of sectors relevant to our business, aswhose members bring key skills and expertise, including those summarized in the charts below. In addition, our directors have executive management or other experience that enables them to effectively contribute business acumen, strategic insight, risk management sensibility, financial comprehension, informed counsel and practical knowledge across the operating dimensionsbelow, for overseeing management’s execution of our enterprise. Below is a summary of somestrategic and operational objectives. Our directors are also financially literate and highly engaged, with strong leadership backgrounds, and academic, professional and personal experiences, which make them well-qualified to serve. The data below reflect the directors serving as of the Board’s attributes.date of this Proxy Statement.

|  Corporate Governance: Experience with public or large private company governance. | ||

|  | |  Enterprise Leadership: Experience as a chief executive or top manager for a commercial or academic organization, including responsibility for implementing business plans and managing results. |

|  Environmental: Experience or expertise with managing or advising on operational environmental matters, or possesses a relevant academic/research background. | ||

|  Finance/Investing: Professional or academic expertise or experience in preparing, auditing or evaluating financial statements, or in managing commercial investments. | ||

|  Government: Experience serving as a public official or in another public position, or working with or advising on regulatory, legislative or policy matters. | ||

|

Homebuilding: Experience or expertise in residential land development or home construction activities. | ||

|

Human Capital Management: Experience in talent management, professional development and/or succession planning. | ||

|

Real Estate: Professional experience in acquiring, managing or selling real estate assets. | ||

|  Retailing: Experience operating or managing retail businesses or operations similar to our design studios. | ||

|

Strategic Risk Management: Experience identifying, assessing and managing critical risks to enterprise wide or business unit strategic plans and achieving strategic objectives. | ||

|

Technological Innovation: Experience with or management of technology applications, advanced products or organizations that develop them. One director has cybersecurity management experience. |

Director Tenure*

Average 7.8 years

*percentages may not total 100% due to Contentsrounding

Director Ages*

Average Age 61

*percentages may not total 100% due to rounding

Director Demographics

| Board Diversity Considerations |

| The Board considers diversity for directors and director candidates as encompassing race, ethnicity, national origin, gender, geographic residency, educational and professional history, community or public service, expertise or knowledge base and/or other tangible and intangible aspects of an individual. Beyond their diverse perspectives, skills and demographic characteristics, 45% of our directors are women or ethnic minorities. Our Board members are situated in regional locations generally in proportion to our business. |

| KB Home ■ 2024 Proxy Statement | 9 |

The Compensation Committee periodically evaluates, with FWC’s assistance, and makes recommendations to the Board regarding compensation and benefits for non-employee directors, with attention to maintaining competitive positioning relative to peer public homebuilders and similarly situated companies. Non-employee director compensation was last adjusted in July 2019. Directors, other than Mr. Mezger, who is not paid for his Board service, are compensated as described below. We also pay directors’ travel-related expenses for Board meetings and Board activities. Our director compensation program is shown in the table below. Directors elected to the Board other than at an annual meeting receive prorated compensation.

NON-EMPLOYEE DIRECTOR COMPENSATION*

| Board Retainer: | $100,000 |

|

|

Equity Grant (grant date fair value): | $162,500 |

Lead Independent Director Retainer: | $40,000 |

Committee Chair Retainers: | $27,500 (Audit Committee)

|

Committee Member Retainers: | $12,500 (Audit Committee)

|

Meeting Fees: | $1,500 (per applicable meeting, as described below) |

| |

Retainers

Each director may elect to receive retainers in equal quarterly cash installments, in unrestricted shares of our common stock or in deferred common stock awards (“stock units”). Equity-based grants are made as described below.

EachEquity Grants

Except as noted below, each director may generally elect to receive their equity grant in common stock or stock units. Grants are made on election to the Board, with the rounded number of shares/units based on our common stock’s grant date closing price. Directors receive a share of our common stock for each stock unit they hold on the earlier of a change in control or leaving the Board. Directors receive cash dividends on their common stock holdings and cash dividend equivalent payments on their stock units. Stock units have no voting rights. If a director has not satisfied their stock ownership requirement (see under “Stock Ownership Requirements”), they can receive only stock units for their equity grant and must hold all shares of common stock until they satisfy the requirement or leave the Board.

Meeting Fees

Directors receive fees for each non-regularly scheduled Board or committee meeting they attend if they have also attended all the same body’s prior meetings in a specified 12-month period. No meeting fees were paid in 2020.during the applicable Director Year, which is the period between our annual meetings.

Indemnification Agreements

We have agreements with our directors, which were updated in January 2024, that provide them with indemnification and advancement of expenses to supplement what our Certificate of Incorporation and insurance policies provide, subject to certain limitations.

Directors’ Legacy Program

From 1995 to 2007, we maintained a Directors’ Legacy Program. Mr. Finchem and Ms. Lora areis the only current directorsdirector who are participants, as is Director Emeritus Kenneth M. Jastrow, II.a participant. Under the program, after a participant’s death, we will make a donation on each participant’stheir behalf of up to $1.0 million directly to up to five participant-designated qualifying charitable institutions or organizations in 10 equal annual installments. Program participants are fully vested in their donation amount; however, neither they nor their families receive any proceeds, compensation or tax savings associated with the program. We maintain life insurance policies to help fund program donations. In 2020,2023, no premium payments were required to be made on policies associated with current directors. The total amount payable under the program at November 30, 20202023 was $14.5$13.9 million.

| KB Home ■ 2024 Proxy Statement | 10 |

| Name | Fees Earned or Paid in Cash ($)(a) | Stock Awards ($)(b) | All Other Compensation ($)(c) | Total ($) | ||||||||||||

| Mr. Barra | $ | 112,500 | $ | 162,500 | $ | — | $ | 275,000 | ||||||||

| Mr. Collins | 120,000 | 162,500 | 1,500 | 284,000 | ||||||||||||

| Ms. Dominguez | 100,000 | 185,000 | — | 285,000 | ||||||||||||

| Mr. Eltife | 122,500 | 162,500 | — | 285,000 | ||||||||||||

| Dr. Gabriel | 112,500 | 162,500 | — | 275,000 | ||||||||||||

| Dr. Gilligan | 137,500 | 162,500 | — | 300,000 | ||||||||||||

| Ms. Kozlak | 100,000 | 172,500 | 1,500 | 274,000 | ||||||||||||

| Ms. Lora | 140,000 | 183,500 | 1,500 | 325,000 | ||||||||||||

| Mr. Niccol | — | 272,500 | 1,500 | 274,000 | ||||||||||||

| Mr. Weaver | 30,000 | 262,500 | — | 292,500 | ||||||||||||

| (a) | Fees Earned or Paid in Cash. These amounts generally represent cash retainers paid to directors per their individual elections. The amount for Ms. Lora includes her Lead Independent Director retainer. |

| Stock Awards. These amounts represent the aggregate grant date fair value of the shares of our common stock or stock units granted to our directors in 2023 based on their individual elections with regard to their retainers and type of equity grant (i.e., shares or stock units). The grant date fair value of each such award is equal to the closing price of our common stock on the date of grant. All grants were made on April 20, 2023. The table below shows the respective grants to our directors in 2023. |

| Name | | (#) | 2023 Stock Unit Grants (#) | |

| Mr. Barra | 3,914 | — | ||

| Mr. Collins | 3,914 | — | ||

| Ms. Dominguez | 4,456 | — | ||

| Mr. Eltife | 3,914 | — | ||

| Dr. Gabriel | 3,914 | — | ||

| Dr. Gilligan | 3,914 | — | ||

| Ms. Kozlak | — | 4,154 | ||

| Ms. Lora | 4,419 | — | ||

| Mr. Niccol | — | 6,563 | ||

| Mr. Weaver | — | 6,323 |

Back to ContentsThe aggregate number of outstanding equity awards held by our non-employee directors at the end of our 2023 fiscal year are shown under “Ownership of KB Home Securities,” exclusive of 2,043 shares of our common stock Ms. Lora holds in a family trust.

DIRECTOR COMPENSATION DURING FISCAL YEAR 2020

| (c) | All Other Compensation. These amounts are additional meeting fees paid in 2023 for a Compensation Committee meeting during the 2022-2023 Director Year. |

| KB Home ■ 2024 Proxy Statement | 11 |

Name | Fees Earned or Paid in Cash ($)(a) |

| Stock Awards ($)(b) |

| All Other Compensation ($) |

| Total ($) | ||||

Mr. Collins | $ | 28,125 |

| $ | 81,250 |

| $ | — |

| $ | 109,375 |

Ms. Dominguez |

| 122,500 |

|

| 162,500 |

|

| — |

|

| 285,000 |

Mr. Eltife |

| 28,125 |

|

| 81,250 |

|

| — |

|

| 109,375 |

Mr. Finchem |

| 120,000 |

|

| 162,500 |

|

| — |

|

| 282,500 |

Dr. Gabriel |

| 112,500 |

|

| 162,500 |

|

| — |

|

| 275,000 |

Dr. Gilligan |

| 137,500 |

|

| 162,500 |

|

| — |

|

| 300,000 |

Mr. Jastrow (c) |

| 121,000 |

|

| 162,500 |

|

| — |

|

| 283,500 |

Mr. Johnson |

| 100,000 |

|

| 192,500 |

|

| — |

|

| 292,500 |

Ms. Lora |

| 162,500 |

|

| 162,500 |

|

| — |

|

| 325,000 |

Mr. Weaver |

| 100,000 |

|

| 185,000 |

|

| — |

|

| 285,000 |

Mr. Wood |

| 100,000 |

|

| 185,000 |

|

| — |

|

| 285,000 |

(a) Fees Earned or Paid in Cash. These amounts generally represent cash retainers paid to directors per their individual elections. The amount for Ms. Lora includes her Lead Independent Director retainer. The amounts for Messrs. Collins and Eltife reflect their election to the Board in October 2020. (b) Stock Awards. These amounts represent the aggregate grant date fair value of the shares of our common stock or stock units granted to our directors in 2020 based on their individual elections with regard to their retainers and type of equity grant (i.e., shares or stock units). The grant date fair value of each such award is equal to the closing price of our common stock on the date of grant. All grants were made on April 9, 2020, except those for Messrs. Collins and Eltife were made on October 8, 2020, the date they were elected to the Board. Ms. Kozlak received a grant of 986 shares of our common stock upon her election to the Board on January 21, 2021. The table below shows the respective grants to our directors in 2020. The aggregate number of outstanding stock awards and option awards held by our non-employee directors at the end of our 2020 fiscal year are shown under “Ownership of KB Home Securities,” exclusive of 2,043 shares of our common stock Ms. Lora holds in a family trust.

| |||||||||||

| Name |

| 2020 Common Stock Grants (#) | 2020 Stock Unit Grants (#) |

| Mr. Collins |

| 2,028 | — |

| Ms. Dominguez |

| 7,199 | — |

| Mr. Eltife |

| 2,028 | — |

| Mr. Finchem |

| 7,199 | — |

| Dr. Gabriel |

| 7,199 | — |

| Dr. Gilligan |

| 7,199 | — |

| Mr. Jastrow |

| — | 7,199 |

| Mr. Johnson |

| 8,528 | — |

| Ms. Lora |

| — | 7,199 |

| Mr. Weaver |

| — | 8,195 |

| Mr. Wood |

| 996 | 7,199 |

Mr. Jastrow served as a director throughout 2020. On January 21, 2021, Mr. Jastrow resigned as a director in conjunction with the Board appointing him as Director Emeritus. For his Director Emeritus service, Mr. Jastrow will receive as compensation the current Board cash retainer, plus the fair value of the standard equity grant, all payable in cash quarterly for each quarterly period of service, as well as reimbursement for service-related expenses.

| Back of Contents | ||

|

The Board will present as nominees at the Annual Meeting, and recommends our stockholders elect to the Board, each of the individuals named below for a one-year term ending at the election of directors at our 20222025 annual meeting. Each nominee is standing for re-election and has consented to being nominated and agreed to serve as a director if elected. Other thanAfter 20 years of service, Ms. Kozlak,Lora has decided not to stand for election at the Annual Meeting and will step down from the Board when her term ends as of the election of directors at the Annual Meeting. Mr. Niccol, who was elected tojoined the Board in January 2021, has also decided not to stand for election at the Annual Meeting and Messrs. Collins and Eltife, who were each elected towill step down from the Board in October 2020, each nominee is standing for re-election.when his term ends as of the election of directors at the Annual Meeting.

Should any of the nominees become unable to serve as a director prior to the Annual Meeting, the named proxies, unless otherwise directed, may vote for the election of another person as the Board may recommend. If the Board’s nominees below are elected at the Annual Meeting, the Board will have 12nine directors.

To be elected, each nominee must receive a majority of votes cast in favor (i.e., the votes cast for a nominee’s election must exceed the votes cast against their election).

FOR | Board recommendation: |

DIRECTOR SUCCESSION AND REFRESHMENT

Although there are no term limits for directors, a director must retire from the Board as of the first annual meeting following their 75th birthday. With several long-standing directors approaching this retirement age over the next few years, the Board proactively developed and implemented in 2020 and early 2021 aspects of a plan to refresh its membership. It elected three new, highly qualified directors — Ms. Kozlak and Messrs. Collins and Eltife — who enhance its diversity and range of skills and expertise. In addition, at his suggestion to enable the Board to elect Ms. Kozlak, and to facilitate an orderly succession process where it can continue to benefit from his insight and experience from 20 years of service as a director, the Board appointed Mr. Jastrow in January 2021 to the newly created position of Director Emeritus for a one-year term. Mr. Jastrow resigned as a director in conjunction with this appointment and therefore will not be standing for election at the Annual Meeting.

Our Corporate Governance Principles provide that a director nominee who fails to win election to the Board in an uncontested election is expected to tender his or her resignation from the Board (or to have previously submitted a conditional tender). An “uncontested election” is one in which there is no director nominee that has been nominated by a stockholder in accordance with our By-Laws. This election is an uncontested election. If an incumbent director fails to receive the required vote for election in an uncontested election, the Nominating Committee will act promptly to determine whether to accept the director’s resignation and will submit its recommendation for the Board’s consideration. The Board expects the director whose resignation is under consideration to abstain from participating in any decision on that resignation. The Nominating Committee and the Board may consider any relevant factors in deciding whether to accept a director’s resignation.

| KB Home ■ 2024 Proxy Statement | 12 |

|

Age: 54 Senior Vice President, | |

|  |

Jose M. Barra is Senior Vice President, Merchandising Décor at The Home Depot, Inc., the world’s largest home improvement retailer. Mr. Barra has served in this role since 2018, responsible for the strategic direction and financial performance of Home Depot’s flooring, paint, kitchen, bath, appliances, lighting, and window coverings. Mr. Barra joined The Home Depot in 2017 and previously served as Senior Vice President of Merchandising Services, where he led a team of more than 26,000 associates and was responsible for the company’s in-store environment, field merchandising and merchandising execution team efforts. Before joining Home Depot, Mr. Barra served as an Executive Vice President of Optum Inc., a diversified health and well-being company and subsidiary of UnitedHealth Group Incorporated, a managed healthcare and insurance company. Prior to that, he served as Executive Vice President of merchandising, essentials and hardlines at Target Corporation, one of the largest retailers in the U.S., where he was responsible for the strategic direction and financial performance of 10 divisions that generated more than 60% of total company revenues. Earlier in his career, Mr. Barra also held positions with McKinsey & Company and served as managing director of the real estate and new business development arm of the largest retail conglomerate in Ecuador. In addition to his proven leadership skills, Mr. Barra is a highly respected retail executive who brings significant experience, expertise and insight into home design, the customer experience and consumer trends, and a presence in the Southeast United States, a significant region for KB Home. Current Public Company Directorships: n KB Home Other Professional Experience: n Board Member, The Home Depot Foundation (2022 – Present) n Senior Vice President, Merchandising Services, The Home Depot, Inc. (2017 – 2018) n Executive Vice President and Chief Executive Officer Consumer Solutions Group, Optum, UnitedHealth Group Incorporated (2016 – 2017; Executive Vice President, 2015 – 2016) n Executive Vice President, Merchandising, Target Corporation (2014 – 2015) |

Age:

Founder and Chairman, theGROUP | ||

Arthur R. Collins is the founder and

Public Company Directorships:

nKB Home n Aflac Incorporated nRLJ Lodging Trust

Other Professional Experience:

(2022 – Present) nChairman, Morehouse School of Medicine Board of Trustees (2008 – Present) n Vice Chair, Brookings Institution Board of Trustees (2014 – 2023) nMember, Meridian International Center Board of Trustees (2011 – 2017) nChairman, Florida A&M University Board of Trustees | ||

| KB Home ■ 2024 Proxy Statement | 13 |

Age: 61 Chairwoman and Chief | Dorene C. Dominguez | |

Dorene C. Dominguez has served since 2004 as Chairwoman and Chief Executive Officer of the Vanir Group of Companies, Inc. and its subsidiaries Vanir Construction Management, Inc. and Vanir Development Company, Inc., which provide a wide range of program, project and construction management services for clients in the healthcare, education, justice, water/wastewater, public buildings, transportation and energy markets throughout the United States. Ms. Dominguez also serves as Chair of The Dominguez Dream, a nonprofit organization that provides academic enrichment programs in math, science, language arts and engineering to elementary schools in underserved communities. Ms. Dominguez has extensive experience in executive management, finance, and civic engagement, as well as significant expertise in project and asset management and real estate development. She also has a substantial presence and is well-regarded in California, an important market for us.

Public Company Directorships:

nKB Home n Douglas Emmett, Inc. nCIT Group (2017 – 2022)

Other Professional Experience: n Advisory Board Member, Aspen Institute Latinos and Society (AILAS) Program (2020 – Present) nBoard of Trustees Member, University of Notre Dame (2018 – Present)

nBoard Member, Pride Industries, nonprofit employer of individuals with disabilities n Board Member, CIT Bank, N.A. (2017 – 2022) n Member, The Coca-Cola Company Hispanic Advisory Council (2016 – 2022) |

|

Age: 64 Founder and Owner, | Kevin P. |

| |

|  | ||

|

| ||

Kevin P. Eltife has been the founder and owner of Eltife Properties, Ltd., a commercial real estate investment firm, since 1996. He also has served since 2018 as the Chairman of The University of Texas System Board of Regents, following his initial appointment to that board in 2017. Previously, Mr. Eltife served as a Texas State Senator and as the Mayor of Tyler, Texas. Mr. Eltife has

Public Company Directorships:

nKB Home Other Professional Experience:

nChairman, The University of Texas System Board of Regents 2017 – Present) n Director, Citizens 1st Bank (2002 – Present) nTexas State Senator (2004-2016; President pro tempore, 2015 – 2016)

nMayor, Tyler, Texas |

|

|

|

|

|  |

|

|

| KB Home ■ 2024 Proxy Statement | 14 |

Age: 70 Director, Richard S. Distinguished Professor | Dr. Stuart A. Gabriel | |

Dr. Gabriel has been since 2007 the

Public Company Directorships:

nKB Home

nKBS Real Estate Investment Trust III, Inc. n KBS Real Estate Investment Trust II, Inc. (2007 – 2023) nKBS Real Estate Investment Trust, Inc. (2005 – 2018)

Other Professional Experience: nDirector and Lusk Chair, USC Lusk Center for Real Estate (1997 – 2007) nAssociate Professor/Professor, Finance and Business Economics, USC Marshall School of Business (1990 – 1997) nEconomics Staff Member, Federal Reserve Board |

Age: 69 Emeritus Director and Senior Fellow at the Hoover Institution on | Dr. Thomas W. Gilligan | |

Dr. Gilligan is

Public Company Directorships:

nKB Home nSouthwest Airlines Co. Other Professional Experience:

nDirector, Hoover Institution (2015 – 2020) nDean, McCombs School of Business (2008 – 2015) nInterim Dean, USC Marshall School of Business 1987 – 2006) nAssistant Professor, California Institute of Technology (1984 – 1987) nStaff Economist, White House Council of Economic Advisors (1983-1984) |

|

|

|

|  |

|

|

| 15 |

Founder and | Jodeen A. Kozlak | |

| Jodeen A. Kozlak is the founder and CEO of Kozlak Capital Partners, LLC, a private consulting firm. Ms. Kozlak previously served as the Global Senior Vice President of Human Resources of Alibaba Group, a multinational conglomerate. Ms. Kozlak also previously served as the Executive Vice President and Chief Human Resources Officer of Target Corporation, one of the largest retailers in the U.S., and held other senior roles in her 15-year career at the company. Prior to joining Target, Ms. Kozlak was a partner in a private law practice. Ms. Kozlak has significant experience and insight into human capital management, talent development and executive compensation across a variety of organizational structures, as well as a strong background in executive leadership. In addition, she is well-known and highly respected in California, which is a

Public Company Directorships:

nKB Home nC.H. Robinson Worldwide, Inc. n MGIC investment Corporation nLeslie’s, Inc. (2020 – 2023)

Other Professional Experience:

nGlobal Senior Vice President of Human Resources of Alibaba Group (2016 – 2017) nExecutive Vice President and Chief Human Resources Officer of Target Corporation |

|

Age: 68 Chairman Service Since: 2016 Chairman and | Jeffrey T. | |

|  | |

|

|

| Jeffrey T. Mezger,

Public Company Directorships:

Other Professional Experience:

nPolicy Advisory Board Member, Fisher Center for Real Estate and Urban Economics at UC Berkeley Haas School of Business (2010 – present) n Policy Advisory Board Member, Harvard Joint Center for Housing Studies (2004 – present; Board Chair 2015 – 2016) nFounding Chairman, Leading Builders of America (2009-2013; Executive Committee member until 2016)

nExecutive Board Member, USC Lusk Center for Real Estate |

|

|

|

|  |

|

|

| KB Home ■ 2024 Proxy Statement | 16 |

Age: 48 Chief Executive Officer | James C. Weaver | |

James C. “Rad” Weaver is CEO and Chairman of CW Interests, LLC, an investment management firm in San Antonio, Texas. He oversees the implementation of the company’s investment strategies, including management of direct investments in private operating businesses. Mr. Weaver is the former CEO of McCombs Partners. He also serves as a director of several private companies including Cox Enterprises, Inc., Circuit of the Americas, Jonah Energy and Milestone Brands. In 2017, he was appointed to the University of Texas System Board of Regents. Mr. Weaver has considerable experience in executive leadership, business strategy and execution, financial planning and analysis, and asset/investment management across a broad range of industries

Public Company Directorships:

nKB Home Other Professional Experience:

n Board Member, The University of Texas/Texas A&M Investment Management Company (Chairman 2022 – Present; Vice Chair 2017 – 2022) nMember, The University of Texas System Board of Regents (2017 – Present)

nMember, The McCombs School of Business Advisory Council (2014 – Present) nSan Antonio Chamber of Commerce Board of Directors (Member 2016 – 2017) nMcCombs Partners (2000-2020; Chief Executive Officer |

2006 – 2020) |

| |

| KB Home ■ 2024 Proxy Statement | 17 |

OWNERSHIP OFOwnership of KB

Home SecuritiesHOME SECURITIES

The table below shows the amount and nature of our non-employee directors’ and NEOs’ respective beneficial ownership of our common stock as of February 16, 2021.26, 2024. Except as otherwise indicated below, the beneficial ownership is direct and each owner has sole voting and investment power with respect to the reported securities holdings.

| Non-Employee Directors | Total Ownership(a) | Stock Options(b) | ||

| Jose M. Barra | 3,914 | — | ||

| Arthur R. Collins | 9,098 | — | ||

| Dorene C. Dominguez* | 21,267 | — | ||

| Kevin P. Eltife | 14,598 | — | ||

| Dr. Stuart A. Gabriel | 35,292 | — | ||

| Dr. Thomas W. Gilligan | 49,442 | — | ||

| Jodeen A. Kozlak | 19,653 | — | ||

| Melissa Lora | 180,619 | — | ||

| Brian R. Niccol | 18,470 | — | ||

| James C. Weaver | 39,285 | — | ||

| Named Executive Officers | ||||

| Jeffrey T. Mezger | 1,766,250 | 274,952 | ||

| Jeff J. Kaminski | 120,872 | 82,486 | ||

| Robert V. McGibney | 60,629 | 34,621 | ||

| Albert Z. Praw | 135,512 | — | ||

| Brian J. Woram | 156,119 | — | ||

| All Directors and Executive Officers as a Group (15 people) | 2,663,548 | 392,059 |

| * | Ms. Dominguez's beneficial ownership reported in our 2023 Proxy Statement overstated her total securities holdings by 12,867 shares as a result of a March 2022 transaction that was not reported until December 2023, as described below. |

| (a) | The total ownership amount includes the stock option holdings shown on the table. No non-employee director or NEO owns more than 1% of our outstanding common stock, except for Mr. Mezger, who owns 2.1%. All non-employee directors and executive officers as a group own 3.2% of our outstanding common stock. The total ownership amount reported for each non-employee director includes all equity-based compensation awarded to them for their service on the Board, encompassing shares of common stock and stock units. Included in Messrs. Mezger’s and Woram’s reported total ownership are 67,807 and 4,255 time-vesting restricted shares of our common stock, respectively. Dr. Gabriel, Ms. Lora and Mr. Kaminski each hold their respective vested shares of our common stock in family trusts over which they have shared voting and investment control with their respective spouses. |

| (b) | The reported stock option amounts are the shares of our common stock that can be acquired within 60 days of February 26, 2024. We have not granted stock options as an element of director and employee compensation since 2016. |

| KB Home ■ 2024 Proxy Statement | 18 |

Non-Employee Directors* | Total Ownership(a) | Stock Options(b) |

Arthur R. Collins | 2,028 | — |

Dorene C. Dominguez | 21,022 | — |

Kevin P. Eltife | 2,028 | — |

Timothy W. Finchem | 181,092 | — |

Dr. Stuart A. Gabriel | 35,222 | — |

Dr. Thomas W. Gilligan | 83,460 | 26,889 |

Robert L. Johnson | 166,002 | 70,849 |

Jodeen A. Kozlak | 986 | — |

Melissa Lora | 221,269 | 44,076 |

James C. Weaver | 23,885 | — |

Michael M. Wood | 56,418 | — |

Named Executive Officers |

|

|

Jeffrey T. Mezger | 2,265,742 | 1,278,252 |

Jeff J. Kaminski | 439,587 | 355,882 |

Matthew W. Mandino | 82,187 | 59,980 |

Albert Z. Praw | 120,651 | — |

Brian J. Woram | 331,899 | 172,642 |

All directors and executive officers as a group (16 people) | 4,033,478 | 2,008,570 |

(a) No non-employee director or NEO owns more than 1% of our outstanding common stock, except for Mr. Mezger, who owns 2.3%. All non-employee directors and executive officers as a group own 4.0% of our outstanding common stock. The total ownership amount reported for each non-employee director includes all equity-based compensation awarded to them for their service on the Board, encompassing shares of common stock, stock units and stock options. Dr. Gabriel, Ms. Lora, Mr. Wood and Mr. Kaminski each hold their respective vested shares of our common stock in family trusts over which they have shared voting and investment control with their respective spouses. (b) The reported stock option amounts are the shares of our common stock that can be acquired within 60 days of February 16, 2021. Non-employee director stock options were last granted in April 2014, as they ceased being a component of director compensation after that date. Some non-employee director stock options held by Mr. Johnson (37,993) and Ms. Lora (11,220) have 15-year terms. The remainder have 10-year terms. For non-employee directors who leave the Board due to retirement or disability (in each case as determined by the Compensation Committee), or death, their stock options will be exercisable for the options’ respective remaining terms. Otherwise, non-employee director stock options must be exercised by the earlier of their respective terms or the first anniversary of a director’s leaving the Board (for 15-year stock options), or the third anniversary of leaving the Board (for 10-year stock options). Based on the non-employee directors’ respective elections, each non-employee director stock option represents a right to receive shares of our common stock equal in value to the positive difference between the option’s stated exercise price and the fair market value of our common stock on an exercise date, and are therefore settled in a manner similar to stock appreciation rights. None held by current directors have been so settled.

* Director Emeritus Mr. Kenneth M. Jastrow, II has a total ownership of 148,560, encompassing shares of common stock and stock units. | ||

|

The following table shows the beneficial ownership of each stockholder known to us to beneficially own more than five percent of our common stock. Except for the Grantor Stock Ownership Trust (“GSOT”), the below information (including footnotes) is based solely on the stockholders’ respective Schedule 13G or Schedule 13G/A filings with the SEC and reflect their respective determinations of their and/or their respective affiliates’ and subsidiaries’reporting such ownership as of December 29, 2023, December 31, 2020.2023 and January 31, 2024, as applicable. Some percentage ownership figures below have been rounded.

Stockholder(a) | Total Ownership | Percent of Class |

BlackRock, Inc. 55 East 52nd Street, New York, NY 10055 | 11,151,919 | 12.3% |

The Vanguard Group, Inc. 100 Vanguard Blvd., Malvern, PA 19355 | 7,865,327 | 8.7% |

KB Home Grantor Stock Ownership Trust(b) Wells Fargo Retirement and Trust Executive Benefits, One West Fourth Street, Winston-Salem, NC 27101 | 7,124,317 | 7.2% |

FMR LLC 245 Summer Street, Boston, Massachusetts 02210 | 4,864,262 | 5.4% |

| Stockholder(a) | Total Ownership | Percent of Class | ||

BlackRock, Inc. 50 Hudson Yards, New York, NY 10001 | 10,694,328 | 13.5% | ||

The Vanguard Group, Inc. 100 Vanguard Blvd., Malvern, PA 19355 | 7,784,840 | 10.3% | ||

KB Home Grantor Stock Ownership Trust(b) Delaware Charter Guarantee & Trust Company dba Principal Trust Company Wilmington, DE 19805-1265 | 6,705,247 | 8.1% | ||

FMR LLC 245 Summer Street, Boston, MA 02210 | 5,007,432 | 6.3% |

(a) | The stockholders’ respective voting and dispositive power with respect to their reported ownership is presented below, excluding the GSOT. |

|

| Blackrock, Inc.(i) | The Vanguard Group, Inc.(ii) | FMR LLC(iii) |

Sole voting power | 10,947,747 | — | 1,373,343 | |

Shared voting power | — | 107,612 | — | |